BDI to face downward pressure

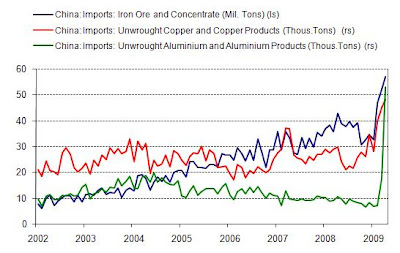

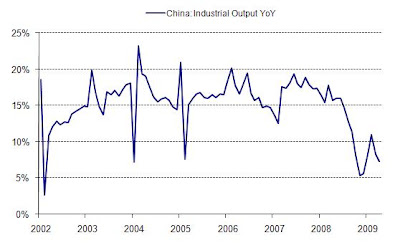

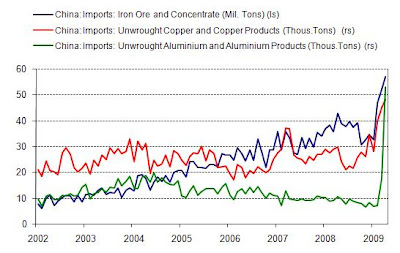

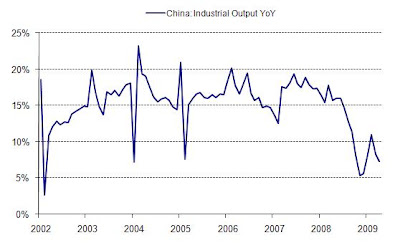

As I have discussed in great detail in my TheStreet.com articles; I believe the recent rally in the Baltic Dry Index (BDI) cannot be sustained, and we are likely to see a pullback in the index; along with dry bulk shipping and mining sector stocks. The BDI’s rally has been driven almost exclusively through China’s record demand for raw material stemming from the government’s USD586bn stimulus package. Currently, despite record raw material imports China’s industrial production has actually begun to wane and export growth has turned negative. To put it simply, there’s a lot more going in than coming out; this cannot be sustained.

Without a significant, yet unlikely, increase in global demand for Chinese goods, current imports will only add to record breaking inventory levels. China is currently at or near its maximum inventory levels; meaning it is very likely we will soon begin to see a drop in China’s extraordinary import levels. This diminishing demand will translate into a correction for the BDI and those sectors with high correlations to the index (i.e. miners, shippers, etc…)

The retraction in the BDI will be exacerbated by a record increment in fleet expansions scheduled to be completed over the next 1.5 years. In fact according to my calculations and data from Barry Rogliano Salles, a Paris based shipbroker, the size of the global capesize fleet, which is the largest class of bulk carrier, is expected to rise by 50%. Many analysts believed this magnitude of expansion was irrational even at the peak of shipping in 2008. Currently, 10% of the estimated 855 global capesize fleet is idle off the shores of China waiting to unload at congested ports, with an average 9 day wait. The growing supply of new vessels combined with the freeing of idle ships off the coast of China will create a supply glut in the sector dragging down shipping prices. Hence my bearish short-term view on the mining sector (BHP, RTP, VALE), and my generally bearish view on the shipping industry, especially for highly leveraged shippers such as Eagle Bulk Shipping (EGLE); companies with lower leverage such as Diana Shipping (DSX) should be better positioned to weather the coming storm. Again for more details please check out my articles on TheStreet.com.

Without a significant, yet unlikely, increase in global demand for Chinese goods, current imports will only add to record breaking inventory levels. China is currently at or near its maximum inventory levels; meaning it is very likely we will soon begin to see a drop in China’s extraordinary import levels. This diminishing demand will translate into a correction for the BDI and those sectors with high correlations to the index (i.e. miners, shippers, etc…)

The retraction in the BDI will be exacerbated by a record increment in fleet expansions scheduled to be completed over the next 1.5 years. In fact according to my calculations and data from Barry Rogliano Salles, a Paris based shipbroker, the size of the global capesize fleet, which is the largest class of bulk carrier, is expected to rise by 50%. Many analysts believed this magnitude of expansion was irrational even at the peak of shipping in 2008. Currently, 10% of the estimated 855 global capesize fleet is idle off the shores of China waiting to unload at congested ports, with an average 9 day wait. The growing supply of new vessels combined with the freeing of idle ships off the coast of China will create a supply glut in the sector dragging down shipping prices. Hence my bearish short-term view on the mining sector (BHP, RTP, VALE), and my generally bearish view on the shipping industry, especially for highly leveraged shippers such as Eagle Bulk Shipping (EGLE); companies with lower leverage such as Diana Shipping (DSX) should be better positioned to weather the coming storm. Again for more details please check out my articles on TheStreet.com.

Join the discussion