Mengniu, A Look at A Chinese Dairy Company

Chinese Mengniu Dairy: China’s Mengniu dairy was founded in 1999 by a group of seasoned dairy market professionals previously employed by the state-owned Yili Dairy. Mengniu began trading on the Hong Kong Stock Exchange in June 2004.

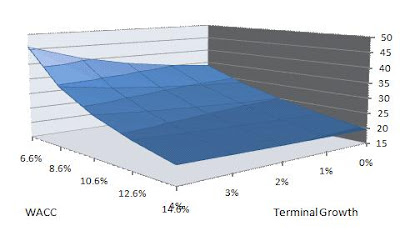

Our DCF based price target is currently HKD26.16: Given Mengniu’s historically strong growth, its ability to generate cash, and continued leading market position in the liquid milk industry we have decided to run a DCF model to value the company’s equity. Using a 10.6% WACC, based on our calculated cost of equity, and a terminal growth rate of 2% starting in 2019 we calculated a price target of HKD26.16. According to our calculations a price target of HKD26.16 would imply a 12 month forward P/E ratio of x26.79 and a 24 month forward P/E ratio of x19.95. This is in-line with Mengniu’s recent performance.

New high-value added products should help sustain Mengniu’s robust growth: We believe that Mengniu through its strong brand, innovative products, and efficient distribution network will be able to ride the wave on the transitioning

ASP should remain stable or see a slight increase as higher value products reach market: A recent increase in government price caps coupled with solid performance of Mengiu’s products should help sustain Mengniu’s ASP for the foreseeable future.

Higher costs should be offset by rising and eventually stable ASP coupled with falling raw milk prices: Higher costs via new product development, company branding and distribution could place downward pressure on Mengniu’s margins.

The Details:

China’s Mengniu dairy was founded in 1999 by a group of seasoned dairy market professionals previously employed by the state-owned Yili Dairy. Mengniu began trading on the Hong Kong Stock Exchange in June 2004. The company’s products include UHT milk, yoghurt, milk beverages, ice cream, milk powder and milk tablets. In 2007 Mengniu reported holding a market share of 40.7% in China’s liquid milk market. This is a significant increase from the 33.3% market share Mengniu held at the end of 2006. Mengniu has experienced significant growth since its creation, primarily through the introduction of UHT milk. As you can see from the chart below the majority of Mengniu’s revenue is derived from the liquid milk business.

Mengniu’s composition by product

Source: Company

Mengniu’s management has brought the company from an industry start-up in 1999 to a market leader in less than 10 years. They have achieved this by developing a strong brand and implementing an innovative business model that led to the successful introduction of new products, such as UHT. However, the biggest challenge for Mengniu’ management will be keeping up with the changing Chinese dairy sector. As we mentioned in the industry outlook section, the industry is undergoing an important transition, where UHT will likely no longer be the dominant force behind the industry’s growth. As it currently stands, management not only seems to be aware of this shift, but appears to once again be positioning itself on the cutting edge. They have started to invest more heavily in R&D projects aimed at designing higher-end products, and are training its raw milk suppliers on how to increase productivity and reduce disease. Nonetheless, it will be very important for management to maintain stable margins amid potential pricing pressure from increased competition and rising marketing costs. Unlike the western dairy market Chinese consumers are more brand conscience, so it will be essential for Mengniu to continue building its name. This notwithstanding, we believe Mengniu is well positioned to take advantages of the changes in the dairy sector given management’s strong track record of innovation, brand development, and efficient distribution networks.

Investment Thesis:

New high-value added products should help sustain Mengniu’s robust growth: We believe that Mengniu through its strong brand, innovative products, and ultra efficient distribution network will be able to ride the wave on the transition from traditional milk products to higher value dairy products. Mengniu has already demonstrated its ability to take advantage of new products and markets when it first introduced UHT milk to the Chinese market. Concurrently, we believe growing UHT sales to rural communities should help off-set someone of the growth slow-down from near saturated urban markets.

ASP should remain stable or see a slight increase as higher value products reach market: A recent increase in government price caps coupled with solid performance of Mengiu’s products should help sustain Mengniu’s ASP for the foreseeable future. We anticipate that despite some downward pressures Mengniu’s new higher value products and price cap increases should help maintain or slightly improve its 2008 ASP.

Higher costs should be offset by rising and eventually stable ASP coupled with falling raw milk prices: Higher costs via new product development, company branding and distribution could place downward pressure on Mengniu’s margins. Yet, we anticipate that in 2008 margin pressure will be more than off-set by reductions in raw milk prices and increases in the ASP for Mengniu’s products. We currently expect Mengniu’s gross margin to improve to 22.8% in 2008 vs. 22.5% in 2007 and to remain somewhat stable in 2009. Since Mengniu owns only a very small percentage of its own livestock and pastures, it remains extremely susceptible to changes in raw milk costs, both on the upside and downside. Meaning a continued moderation in raw milk prices could have a large positive impact on Mengniu’s bottom line. Based on the current inflation outlook we expect raw milk prices will continue to moderate, eventually stabilizing by year end.

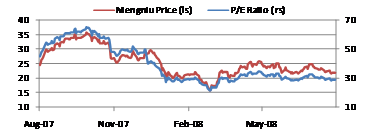

Our DCF based price target is currently HKD26.16: Given Mengniu’s historically strong growth, its ability to generate cash, and continued leading market position in the liquid milk industry we have decided to run a DCF model to value the company’s equity. Using a 10.6% WACC, based on our calculated cost of equity, and a terminal growth rate of 2% starting in 2019 we calculated a price target of HKD26.16. Please take a look at the chart below for our model’s sensitivities to changes in WACC and the terminal growth rate. According to our calculations a price target of HKD26.16 would imply a 12 month forward P/E ratio of x26.79 and a 24 month forward P/E ratio of x19.95. This is in-line with Mengniu’s recent performance as can be seen in the chart below.

Source: My Calculations

Source: My Calculations

Key Risks:

There are several significant risks to our forecast. First and foremost, any significant spikes in raw milk prices or supply constraints could have a detrimental impact on Mengniu’s business. Raw milk is the essential input for all of Mengniu’s products, and unlike some of its competitors Mengniu does not own its own livestock or pastures making the company extremely vulnerable to price shifts or supply shocks in the raw milk market. With this said, given the current CPI outlook we believe raw milk prices will continue to moderating and remain flat by year’s end. Also important to note is that Mengniu has setup an extremely efficient supply chain in Inner Mongolia to source raw milk. It essentially holds a duopoly with Yili Dairy on all raw milk sources in Inner Mongolia, so a supply shock is unlikely.

Another risk is Mengniu’s new higher value added products failing to capture market share. This would significantly hamper Mengniu’s business given the expected slowdown in its core UHT milk sales. However, based on Mengniu’s prior track record of successfully developing and introducing new products we do not find this outcome to be very probable. However, there is a real possibility Mengniu may not meet our aggressive sales forecast.

A number of factors could put downward pressure on Mengniu’s ASP: We expect the higher value dairy products market to become increasingly competitive as China’s other dairy producers introduce new high-value products. We also anticipate higher penetration and sales volumes through China’s hypermarket/supermarket format retail chains. These format stores, given the large volumes purchased, tend to place considerable pricing pressure on producers, adversely effecting ASP. Mengnui’s strong brand name and innovative products should help buffer some of these negative effects on ASP. Lesser risks are potential changes to the 2008/09 effective tax rate, and any potential increase in sales and distribution costs effecting bottom line margins. Additionally, there is always a possibility new government policies related to the price caps of dairy products could adversely affect Mengniu’s future performance.

A Look at the Financials:

Turnover: We anticipate turnover will continue to grow at a healthy pace of around 33% for FY2008. This will be in response to a combination of higher sales volumes and better than market anticipated ASP. We expect yoghurt to experience the highest level of growth for the year at 44%. However, UHT will remain the dominant product consisting of 59% of Mengniu’s sales, but only growing 32%y/y. We believe the recent moderation in overall CPI should help benefit Mengiu as middle class consumers may be more inclined to spend as incomes and disposable income continue to rise.

Mengniu’s Sales Growth by Product

Source: The Company & My Forecasts

Margins: We believe that given the increase in price caps for Mengniu’s products, coupled with the moderation in raw milk prices, gross margin should regain some footing lost in 2007. We are currently forecasting the gross margin to finish 2008 at 22.8% vs. 22.5% in 2007. For 2009, we expect the gross margin to remain relatively stable finishing the year at 22.9%. Mengniu’s gross margin will likely remain below that of its major competitors, primarily due to the company’s limited scope. On the plus side, if raw milk prices continue their current decline until year end, then we could see higher than anticipated margins, given Mengniu’s susceptibility to input prices. At the same time, given increased marketing and selling costs we anticipate operating and net margins to remain in-line with 2007’s level of around 5.3% and 4.4%, respectively.

COGS & Selling, Distribution Costs: A significant portion of Mengniu’s COGS is raw milk prices, which up until the beginning of this year have experienced a sharp rise. Raw milk prices have begun to moderate, but given the strong base increase at the beginning of the year we are anticipating COGS to increase around 33% for the year versus 31.2% in 2007. Compared to its competitors Mengniu maintains among the lowest selling and distribution expenses. This is primarily due to management’s ability to conduct concise and effective marketing and the company’s strong distribution network. We believe Mengniu’s strong distribution network and talented marketing team will off-set some of the costs pressures to the new Chinese dairy market dynamics leading to an increase in selling distribution of around 33% for 2008, permitting the company to maintain its competitive advantage vs. its competitors in this area.

Net Profit: We are currently forecasting net profit growth of 34.6% for 2008 and 32.7% in 2009. This would imply a net profit margin of 4.4% for both 2008 and 2009. We believe increased in the effective tax right will likely prevent these margins form realizing any significant upside.

Great post. Mengniu has been on my radar screen for several years. It will be interesting how the milk scandal affects them. My guess is that the government will step in and regulate the industry, which will benefit the established players such as Mengniu and Yili.

its revenue suffered heavily in the recent few months and may not be able to recover to its pre-September level within the whole of 2009.