Chinese Financial Sector ADRs

As a follow-up to my energy sector ADR piece I am going to take a look at the Chinese and Hong Kong Financial sector ADRs. There are 3 Chinese and Hong Kong ADRs within the GICS financial sector: China Life Insurance (LFC), E-House (EJ), and Xinyuan Real Estate (XIN).

Chinese & HK Financial Sector ADRs

The Companies:

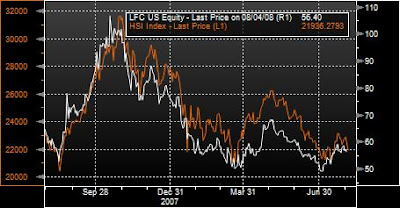

China Life Insurance (LFC, Outperform): China Life Insurance Co., Limited offers a wide range of life, accident, and health insurance products and services. LFC is the largest life insurance provider in China. (Bloomberg)

LFC’s outlook in a nutshell: Several factors have gone into LFC’s poor ytd performance, including large potential payments due to the Sichuan earthquake and poor overall market performance. But in retrospect, it does not appear Sichuan earthquake related payments will be as high as some analyst had anticipated. In fact, it appears the Sichuan earthquake may have increased demand by Chinese consumers for life insurance related products; this should help bolster LFC’s premium growth through-out 2008. Recently, it was estimated that LFC’s life insurance premiums increased 50% during the first 5 months of 2008. Based on continued strong demand and LFC’s vast potential client base and large distribution network, especially in rural China; I expect strong premium growth to be supported for the foreseeable future. Nonetheless, LFC could face some downward pressure from its investment business and the possibility of compressed new business margins due to the increased sale of single-premium products vs. regular premium. Investment income could also be affected this year by a recent rule preventing insurance companies from guaranteeing Chinese corporate debt. The Chinese government has also recently introduced new solvency rules for the insurance industry. The new solvency rule break insurance companies into three categories based on their solvency margins, insolvent (<100%),>150%). The good news is as of Dec. 2007 LFC’s solvency margin was over 5x the government minimum, so we expect the regulations to have minimal short-term business impact. All in all I believe strong demand for insurance products coupled with the under-development of the Chinese insurance industry and LFC’s strong distribution network, LFC could see some considerable upside in the future. (Expected Q208 Earnings Report 8/25/08)

Events which could improve outlook:

- Continued premium growth through the second half of 2008.

- Strong performance of Chinese equity markets.

- Higher than anticipated investment yields.

Events which could deteriorate outlook:

- Slow-down in premium growth and/or tightening margins.

- Poor equity market performance.

- New government regulation affecting LFC’s bottom line.

E-House (EJ, Outperform): E-House China Holdings Ltd. offers real estate services. The Company offers primary real estate agency services to residential real estate developers; lists and brokers properties for resale; and offers land acquisition consulting and property development consulting services. (Bloomberg)

EJ’s outlook in a nutshell: The Chinese real estate sector has been facing significant downward pressure. Unlike the US however, the primary catalyst for this adjustment is derived from escalating government restrictions targeting the sector. These regulations include everything from restrictive lending policies to quotas for land development. (Click here for a more comprehensive list) Consequently, the performance of all real estate related equities has suffered including EJ. Nonetheless, despite this EJ was still able to post solid 1Q08 numbers beating analysts’ estimates, demonstrating 107%yoy revenue growth. Looking ahead to 2Q08 earnings EJ has affirmed its revenue projections of between USD41mn to USD44mn, or a roughly 75% increase from the year prior. We believe that EJ is also in a relatively good position for the remainder of 2008 for the following reasons: 1) Continued growth in EJ’s real estate consulting and information services segment. This should be driven by EJ’s leading market position in the real estate consulting service industry and by subscriptions to EJ’s innovative CRIC information database; 2) Developers demand for increased cash flow and sales turnover should help sustain revenues and growth for EJ’s primary real estate agency services, which could also lead to further developer alliances. Given current conditions it is also likely some developers are holding off some projects until the end of 2008, which could help 2H08 earnings for EJ, or at least indicate a potential turn-around for the sector; & 3) A potential loosening of restrictive government policies related to the real estate sector. The recent slowdown in economic growth will likely cause the Chinese government to reconsider certain restrictions placed on the sector to help bolster domestic growth. Based on analysts’ earnings projections and our back of the envelope discounted free cash flow model we believe a target price of $18.00-$20.00 would be a fair value for EJ. Regardless of the current conditions in the Chinese real estate industry, we believe EJ is well positioned for growth and is a good play in the Chinese financial sector ADR universe. (Expected Q208 Earnings Report 8/20/08 Pre-market)

Events which could improve outlook:

- Government easing restrictions related to the real estate sector, especially leading to easier credit.

- Increased consulting fees or higher than expected subscriptions to the CRIC system.

- Growth in home prices and/or real estate transactions.

- Announcing additional alliances with developers.

Events which could deteriorate outlook:

- Further government restrictions in the real estate sector

- Lower than expected consulting fees and CRIC subscriptions

- Missing 2Q08 earnings target of USD41 – USD44mn or 2008’s, which could put in question 2008’s full year target of USD210mn to USD240mn.

Xinyuan Real Estate (XIN, Neutral): Xinyuan Real Estate Company, Ltd. is a residential real estate developer that focuses on Tier II cities in China. The Company develops large scale residential projects that include multi-layer buildings, sub-high apartment buildings, hospitals, schools, and others. Xinyuan also develops small scale properties as well. (Bloomberg)

XIN’s outlook in a nutshell: Due to credit restrictions and other policies aimed at real estate developers we believe XIN will remain under pressure for the rest of 2008. Nevertheless, XIN primarily focuses on tier II Chinese cities with projects primarily centered in Chengdu, Zhengzhou, Hefei, & Jinan. On average these cities have fared better than tier 1 cities in terms of slowing home price growth and diminishing demand. However, while year over year housing prices remain positive in these cities, we have begun to see a significant slow-down in recent data. June’s yoy housing price growth in Chengdu and Zhengzhou has slowed by -19.6% and -10.0%, respectively, from the month prior. The drop-off in demand for housing will likely continue to strain prices and sales in XIN’s target markets. However, any pro-real estate shifts in government policy that would bolster demand (i.e. increase credit), could have a significant impact in XIN’s business. XIN like many developers are likely in a wait in see mode when it comes to future expansion plans. We believe given the current stress on the Chinese real estate industry, and XIN’s front-line position we would prefer waiting for clear indications of the sectors recovery before considering an investment. We anticipate having a clearer picture of the Chinese real estate developer landscape by the end of 2008.

Events which could improve outlook:

- Government easing restrictions related to the real estate sector, especially leading to easier credit

- Strong sales on current projects.

- Recovery in real estate transaction volume combined with stable or rising housing prices.

Events which could deteriorate outlook:

- Further restrictions on credit availability.

- Rising construction costs on current projects.

- Deterioration of sales on current projects.

- Continued slow-down of housing price growth in target cities.

Interesting info. We all in Toronto life insurance brokers consider China the most ideal future market for insurance business, despite political atmosphere (which is actually not so bad, as I believe…) and high risk of vast natural disasters. It has to be something completely different, to work on such market, opened to many new opportunities and providing many challenges for insurance professionals. I don’t think I will ever face such situation here in Canada…

Take care!

Lorne