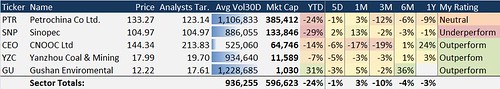

Chinese Energy Sector ADRs

Source: Bloomberg, analyst targets are an average provided by Bberg &for reference only

The Companies:

PetroChina (PTR, Neutral): PetroChina Company Limited explores, develops, and produces crude oil and natural gas. The Company also refines, transports, and distributes crude oil and petroleum products, produces and sells chemicals, and transmits markets and sells natural gas. All of PTR’s oil and gas production and reserve facilities are located within China. (Bloomberg)

PTR’s outlook in a nutshell: China’s continued strong economic growth should support increased demand for natural gas and petroleum products. However, domestic production of crude oil and natural gas has not and will not be able to keep up with the demand for refined energy products. This means PTR and other energy companies will have to rely more heavily on imported energy products. Currently, China imports roughly 50% of its crude oil, and we anticipate this percentage will rise, as China is now a net importer of oil. One of the catalysts behind the pickup of energy imports is the government’s oil tax rebate which rebates 75% of the 17% VAT tax on crude imports, and a full discount on the importation of gas and diesel. Currently, it appears this discount will stay in place through 3Q08, but it will be important to watch. It is likely that without these imports China could face more significant domestic energy shortages. All in all we believe that PTR’s margins will continue to come under pressure, and the ADR has limited upside, especially verses other ADR plays. With this said however, we believe PTR is in the better position than SNP. The reason being PTR holds the majority in both domestic crude oil and natural gas production. (Expected Q208 Earnings Report 8/21/08)

Events which could improve outlook:

- Slowdown in global oil prices.

- Increase in domestic price caps in gas.

- New oil field discoveries.

Events which could deteriorate outlook:

- Sharp rise in global oil prices.

- End to energy import tax rebate.

- New or stronger government regulations which could increase PTR’s cost.

Source: Bloomberg

Sinopec (SNP, Underperform): China Petroleum and Chemical Corporation (Sinopec) explores for and produces crude oil and natural gas in China. The Company also owns refineries that make petroleum and petrochemical products such as gasoline, diesel, jet fuel, kerosene, ethylene, synthetic fibers, synthetic rubber, synthetic resins, and chemical fertilizers. In addition, Sinopec trades petrochemical products. SNP is currently China’s largest oil refiner. (Bloomberg)

SNP’s outlook in a nutshell: Like PTR, Sinopec is expected to face difficultly due to high oil prices compressing margins. Unlike, PTR however, SNP is much more vulnerable to the current government tax reductions for crude importation; SNP currently imports roughly 80% of the crude oil it refines. Good news for SNP is that it appears the VAT reductions should remain in place through Q3, but any changes to that could significantly impact SNP’s bottom line. Even with the recent drop in WTI prices it has been reported by company officials by the Xinhua news agency that the company’s break-even point is a WTI price of around USD80, far below current levels. Given this pricing pressure I see limited upside for SNP. It is also hard to predict what type of government intervention may take place to support the local energy industry, given this unknown it is an area I would like to avoid. (Expected Q208 Earnings Report 8/25/08)

Events which could improve outlook:

- Slowdown in global oil prices.

- Increase in domestic price caps for refined products.

- Greater expansion at its Tahe oil-field.

- New oil-field discoveries bolstering E&P earnings

Events which could deteriorate outlook:

- Further drop in refining margins.

- Any changes to reduce the magnitude or length of the VAT subsidies.

- New or stronger government regulations which could increase PTR’s cost.

Source: Bloomberg

CNOOC (CEO, Outperform): CNOOC Limited, through its subsidiaries, explores, develops, produces, and sells crude oil and natural gas. (Bloomberg)

CEO’s outlook in a nutshell: Unlike PTR & SNP, CEO has significant exposure to E&P, which in a period of high oil prices should add considerably to the bottom line. At the same time, CEO has recently started production at its Xijuan 23-1 oil field and has numerous more scheduled to go online during the remainder of 2008. This should help CEO reach their roughly 15% production increase from last year. All in all, in the current oil piece environment, and with numerous projects already or nearly ready to go online we believe CEO is a good play in the Chinese energy sector. (Expected Q208 Earnings Report 8/27/08)

Events which could improve outlook:

- Higher international oil prices.

- New oil and/or gas discoveries could improve CEO’s long-term outlook

- Better than expected production especially at newly operational Xijian 23-1 oil field or others scheduled to come on line this year.

Events which could deteriorate outlook:

- A significant drop in global oil prices

- Not reaching 2008’s target production growth.

- Increased costs which could impact the bottom line.

CEO vs. Hang Seng

Source: Bloomberg

Yanzhou Coal Mining (YZC, Outperform): Yanzhou Coal Mining Company Limited operates underground mining and coal preparation and operation businesses. Its products are sold in domestic and international markets. The Company also provides railway transportation services. (Bloomberg)

YCZ’s outlook in a nutshell: Like its oil and gas counter parts YZC is susceptible to Chinese government price control policies. Despite this coal prices have remained elevated and this should benefit YCZ’s bottom line. Looking at YZC’s 1Q08’s earning release it would appear that YCZ has begun to shift its focus to producing coking coal vs. thermal coal, which has helped company margins. WE believe this trend will continue for the following reasons: According to a Wall Street Journal article coking coal, unlike thermal coal, isn’t effected by recent government price caps. At the same time the article quotes UOB Kayhian analyst Karen Li as saying, “We are bullish on China’s coking-coal sector because of the current tight-market-supply situation.” YZC saw profits from coking coal exceed that of thermal coal for the first time in 2007. Addtionally, YZC owns a majority stake in a new methanol project, which is scheduled to begin production this year. The operation will use thermal coal to produce ethanol, with the first deliveries being made in 2H08. All in all, factoring out any potential government intervention further regulating coals prices or impacting YZC’s cost, we believe YZC is a good play in the Chinese energy market. (Expected Q208 Earnings Report 8/15/08)

Events which could improve outlook:

- Continued strength in coal prices.

- Further shift into higher margin coking coal.

- Success of methanol project and increased coal production at plants in operation.

Events which could deteriorate outlook:

- Weakening in coal prices.

- New Government policies restricting coal prices or export quotas.

- Transportation issues regarding coal delivery.

YZC vs Hang Seng

Source: Bloomberg

Gushan (GU, Outperform): Gushan Environmental Energy Limited produces biofuel. The Company produces biodiesel and by-products of biodiesel production, including glycerin, plant asphalt, erucic acid and erucic amide. (Bloomberg)

GU’s outlook in a nutshell: GU essentially turns waste oil into bio-diesel, and they do this rather successfully. In fact 1Q08 saw impressive increases in net income and revenue. This was primarily due to higher sales volume and prices. For the remainder of 2008 June’s diesel fuel price increase, and any future increase, should help benefit GU’s margins. Additionally, GU has started selling its bio-diesel product to the chemical industry, which according to the company sells at an average RMB800 premium over sales to the diesel industry. In 1Q08 this accounted for 10% of total sales volume; the company expects this could reach 30% by the end of 2008. GU also has numerous ongoing projects to increase bio-diesel production, which is expected to total 400tons by the end of 2008 vs. 240tons in 2007. GU’s Shanghai plant began operations in June while Beijing’s plant became operational in January and is expected to double capacity in 4Q08. Moreover, two new plants are expected to become operational during that time period. It is anticipated that GU will announce 2009’s expansion plans during 2Q08’s conference call on August 11th. According to company officials all expansion is being paid for through cash on hand and cash flows without the use of leverage. Costs increased somewhat significantly for GU in 1Q08 due to higher than expected inflation caused by the Sichuan earthquake, but more recently costs have begun to moderate as Chinese inflation growth has slowed. Moreover, GU’s proprietary technology allows them to use lower quality waste oils than their competitors giving them a cost advantage in the sector. On average GU expects input costs to increase roughly in-line with the Chinese inflation rate. All in all given the current demand and potential shortages for diesel combined with GU’s entrance into the chemical market; we are optimistic about the company’s future, and believe the company could have significant upside. This is my favorite play in the Chinese ADR energy sector. (Expected Q208 Earnings Report 8/11/08)

Events which could improve outlook:

- Increases in the governments diesel fuel price cap

- Larger volumes being sold into the higher margin chemical industry.

- Meeting production targets and bringing new plants online within the targeted time frame.

Events which could deteriorate outlook:

- Significant rise in input prices effecting margins.

- Drop off in business to the chemical industry.

- Supply chain issues on sourcing waste oils.

Join the discussion