A Look at Chinese and Hong Kong ADR’s

As everyone by now has realized decoupling of the financial markets holds less credibility than the Loch Ness monster. This notwithstanding, I anticipate growth in developing emerging market economies, especially China, will continue to outpace their industrialized counter parts in the years to come, albeit it not at the pace we have grown accustomed to seeing. It is also very likely we will see domestic demand take over as the new engines of growth in these economies. The cause is simple, industrial nations, particularly the US, will experience slowdowns in consumption, hence overall growth over the next several years as wealth continues to deteriorate. The effect, less demand for foreign goods will likely cause trade balances to become a drag on growth for many EM export oriented economies On the other hand, this should be at least partially off-set by what I expect to be continued strong growth in the domestic sector. Domestic Consumption and investment should remain robust for many EM countries after experiencing high growth and a developing domestic economies.

With that said lets look at China, where the global slow-down coupled with an appreciating currency is a double whammy for exports. But how has the Chinese domestic market performing? In a nutshell the answer is good. According to China’s 2Q08 GDP figures domestic investment and consumption continue to experience significant growth. In fact, the June retail sales figure demonstrated 23%yoy growth. So why have Chinese equities faced such a bad year? Well I don’t believe there is any one specific reason for this, but a combination of factors including fears of monetary tightening, investors’ flight to quality, and liquidity issues in the global financial sector stemming from the housing crisis. I anticipate that as fears ease and liquidity returns to the market we could see a significant buy-back of Chinese equities. Additionally, as the Chinese export sector continues to deteriorate there is a growing possibility we could see a pull-back of domestic macro-policies aimed at preventing the over-heating of the domestic economy. This could include anything from increasing loans quotas to reducing reserve requirements. With this said, in the long-run I am bullish on the Chinese domestic sector, while slightly bearish on export oriented industries. There are of course risks, and I advise you to read some of my previous posts and other research. I will go into further detail on sectors and companies in future posts. Now let’s look at the ADRs:

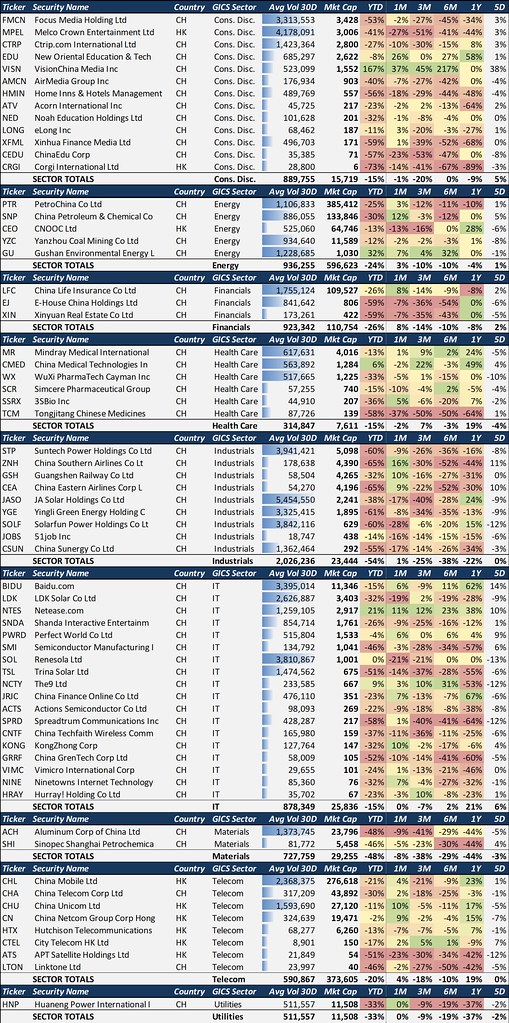

Year to date the 66 Chinese and Hong Kong ADRs I tracked lost 24.0% of their value in market weighted terms, significantly outperforming the domestic Shanghai SE Composite Index which returned -45.6% during the same period, but underperforming Hong Kong’s Hang Seng Index which returned -18.4%. The best performing company was China’s VisionChina Media (VISN) which returned 167.1%ytd, while the worst performer was Hong Kong’s Corgi International (CRGI) which lost 73.0% during the same time period. Interesting to note is that in 2007 nearly 70% of Corgi’s revenues were derived from the US. The best performing GICS sectors for the ADRs were consumer discretionary, health care and IT which all lost 15%ytd in market weighted terms. The worst performing sector has been industrials, which lost 54%ytd. Please look at tables below for further details:

ADR’s sorted by Sector & Market Cap*

Source: Bloomberg

To be continued…

Quick Description from Bloomberg of top 10 ADRs by Market Cap

- PetroChina (PTR): PetroChina Company Limited explores, develops, and produces crude oil and natural gas. The Company also refines, transports, and distributes crude oil and petroleum products, produces and sells chemicals, and transmits markets and sells natural gas.

- China Mobile (CHL): China Mobile Limited, through its subsidiaries, provides cellular telecommunications and related services in the People’s Republic of China and Hong Kong SAR.

- China Petroleum & Chemical (SNP): China Petroleum and Chemical Corporation (Sinopec) explores for and produces crude oil and natural gas in China. The Company also owns refineries that make petroleum and petrochemical products such as gasoline, diesel, jet fuel, kerosene, ethylene, synthetic fibers, synthetic rubber, synthetic resins, and chemical fertilizers. In addition, Sinopec trades petrochemical products.

- China Life Insurance Company (LFC): China Life Insurance Co., Limited offers a wide range of life, accident, and health insurance products and services.

- CNOONC (CEO): CNOOC Limited, through its subsidiaries, explores, develops, produces, and sells crude oil and natural gas.

- China Telecom (CHA): China Telecom Corporation Limited, through its subsidiaries, provides wire line telephone, data, and Internet, as well as leased line services in China.

- China Unicom (CHU): China Unicom Limited, through its subsidiaries, provides telecommunications services in the People’s Republic of China. The Company’s services include cellular, paging, long distance, data, and Internet services.

- Aluminum Corporation of China (ACH): Aluminum Corporation of China Limited is a producer of alumina and primary aluminum in China. The Company refines bauxite into alumina and smelts alumina to produce primary aluminum.

- China Netcom (CN): China Netcom Group Corporation (Hong Kong) Limited is a fixed-line telecommunications operator in China and an international data communications operator in the Asia-Pacific region. The Company provides broadband and other Internet-related services, including DSL and LAN services, business and data communications.

- Yanzhou Coal Mining (YZC): Yanzhou Coal Mining Company Limited operates underground mining and coal preparation and operation businesses. Its products are sold in domestic and international markets. The Company also provides railway transportation services.

**Disclaimer: Author holds long positions in China Mobile(CHL) & EHouse (EJ)

I am interested in CHL either.

Could we exchange some ideas?

Tony.blasco@gmail.com