Gold a Bet Against the Fed

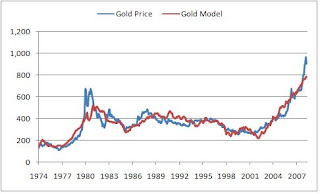

With this in mind I created a back of the envelope analysis to calculate monthly gold prices from 1974 to today based on CPI, the USD broad index, and effective fed funds rate. The results were surprisingly promising:

|

Regression Statistics |

|

||

| R^2 | 0.83 |

|

|

|

|

Coefficients |

T Score |

|

|

Intercept |

-28.1 |

-1.8 |

|

|

CPI |

7.5 |

40.2 |

|

|

USD Broad Index |

-8.5 |

-29.0 |

|

|

Fed Funds |

1108.8 |

10.2 |

|

This simple model has tracked gold price fairly accurately since 1974

*Source: BBerg

The graph above shows that according to the model current gold prices are somewhat elevated, but this is likely due to increasing inflation expectations and recent uncertainty in the financial markets, which this model does not account for. What this model does imply however is that if you believe the Fed will act to combat inflation and we see an appreciation in the USD due to increased rates we are likely to see a decline in gold prices. For example, leaving CPI constant, according to the model if Fed Funds were to move to 3.0% and we saw a 5% appreciation in the USD broad index we would se a decrease in gold prices to about USD750, with a 10% USD appreciation we would see gold prices around USD700. Further increases in CPI could off-set some of these losses, but our view is that the Fed’s actions will be enough to curtail increasing inflation expectations, and bring core CPI back into the Fed’s comfort zone, thus in the long run bringing gold prices closer to its historical average.

It is important to note the simplistic nature of this model and is only meant to highlight the mechanics behind how CPI, USD, and rates affect gold prices leaving out many other important factors. In what we would consider an unlikely case if the Fed was unable to control inflation then we would likely see a further jump in gold prices coupled with an appreciation of the USD broad index as he Fed increases rates. Again, we do not advise trading on this simple model.

Join the discussion