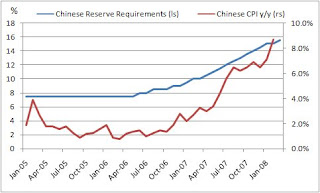

Chinese Monetary Policy vs. Inflation FIGHT!

Policy makers in China have not only continued their anti-inflationary rhetoric, but have started acting on it. We have seen the RMB reach several new highs verse the USD in recent days (7.01). Additionally, Chinese authorities have increased reserve requirements for the second time this year by 50bp to 15.50%. It does not appear this news has settled too well with Chinese equities markets, which have experienced a significant sell-off from the combined fears of tighter monetary policy, a stronger RMB, and possible global slowdown. As a result, local investors seeking more attractive yields have started moving away from EQ and into the domestic fixed income market; yields have rallied accordingly. We expect this trend to continue.

Fears of a global economic slowdown and tighter monetary conditions have begun to show up in the SSE Composite…

Source: Bloomberg

This was not unexpected, as we outlined in an early posting, this how we expect Chinese policy makers to combat high inflation levels:

1) The Central Bank will increase interest rates, which it hasn’t done since December 07;

2) They will allow the RMB to appreciate at a faster rate;

3) They will implement new or stronger policies to reduce monetary growth. (i.e. Higher reserve requirements).

Additionally, we believe the government will continue to enforce its recent price control measures. With that said it is highly likely the Chinese government will continue increasing reserve requirements and continue appreciating the RMB at a faster rate. Given the recent weakness of the USD, the RMB has weakened substantially against the Euro, which probably implies European officials will begin placing pressure on the Chinese officials for quicker appreciation. We also expect to see increases in the Chinese reference rate, the last increase occurred at the end of December.

The Chinese Reserve Requirement Ratio has been increased steadily with inflation, and will continue to rise…

Chinese officials will continue to speed up appreciation of the RMB to combat inflation…

Investment Idea: We see potential upside in the domestic Chinese Steel industry. We have seen an increase in domestic demand as the country continue to develop and we believe the industry is ripe for consolidation. We may actually see the amount of Chinese steel exports decrease this year due to increased local demand, higher export tariffs, and an appreciating RMB. A reduction in Chinese steel exports could put upward pricing pressures on the global market. We also expect domestic steel makers to increase domestic prices as international prices rise. In fact, Baosteel has already announced price increases and may adjust prices on a monthly basis vs. quarterly previously. This of course will put further pressure on Chinese inflation. Which means it will be important to monitor to what degree government officials allow steel producers to pass costs to consumers. However, for steel, we see plenty of demand and a sticky supply. The bottom line is in 2008 look for higher steel prices, industry consolidation, and fewer exports from China (reducing the global supply). We believe this should directly benefit Brazil (ETF:EWZ), especially domestic iron ore producers. Brazil’s largest exports to China are soybeans and iron ore. However, there is a risk that a global economic slowdown could adversely affect steel demand.

.

Join the discussion