An Overview of the Chinese Dairy Market

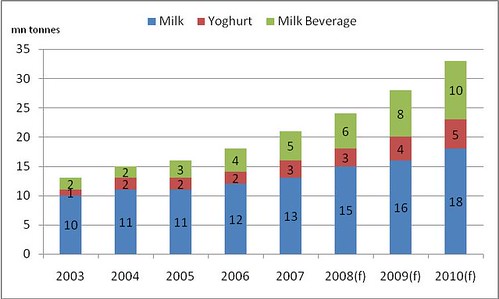

Chinese Dairy Consumption 2003-10

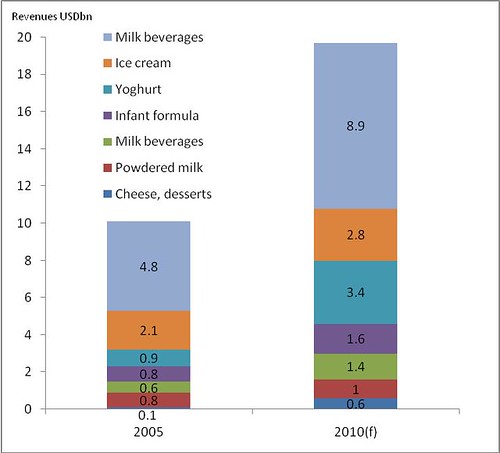

Over the past 8 years the bulk of the dairy sector’s growth came through liquid milk, specifically ultra high temperature (UHT) milk. However, we believe as consumer tastes become more sophisticated and income rises the primary growth engine will shift to higher value products such as ice cream, yoghurt, and milk based products, especially in China’s urban centers. Currently, studies imply that the CAGR 2005-2010 of cheese desserts (38%), milk beverages (22%), infant formula (17%), and yoghurt (31%) will all match or exceed that of milk (17%). (Please see the chart below for a more detailed breakout). These growth rates are congruent with bringing China’s dairy distribution in-line with that its major Asian peers. China’s increased consumption of dairy products is also being assisted by the government’s ‘500 Gram Declaration’ which essentially is the government’s hope that every Chinese citizen, especially children, are able to drink 500 grams of milk on a daily basis. This initiative was primarily motivated by the potential health benefits of dairy products. One of the major roadblocks for the dairy industry is the dispersion of Chinese consumers between urban areas with easy access to a wide variety of dairy products and rural sections with limited access and infrastructure challenges. Nevertheless, infrastructure in China is slowly being developed and the large untapped potential of China’s rural areas should continue to be unlocked.

Chinese dairy industry revenue distribution

Source: McKinsey ‘China’s booming dairy market’

In 1998 only 29% of China’s milk sales were made at modern supermarket/hypermarket stores, but by 2005 this number totaled 58% and is expected to reach 2/3’s of total sales by the end of the decade. China’s entry into the WTO, among other things, significantly reduced barriers for foreign retailers to start or expand operations in China. Based on this fact and the continued development of rural infrastructure we expect the penetration of foreign and domestic supermarket/hypermarket style retail chains to continue growing sharply in China. However, this can be a double edge sword for the Chinese dairy industry. While sales volumes are likely to increase dramatically through higher consumer access to super/hypermarkets, we anticipate greater pricing pressures on dairy manufacturers as these companies tend to have strong bargaining power. This could potentially place stress on dairy products ASP, leading to a reduction in margins. To counter this, dairy companies will need to increase spending on brand recognition and developing new innovative products. Chinese consumers, unlike western consumers, tend to be very brand conscience in relation to the dairy industry.

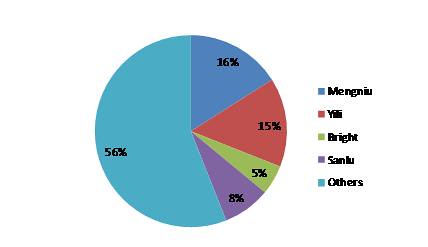

Key players in the Chinese dairy market:

In 2006 China’s four largest dairy companies represented 44% of the total dairy market share. The largest of these was Mengniu with a market share of 16% during the period followed by Yili with 15% market share. Market share for both of these companies has been increasing over the past several years, while China’s other top two companies by market share Bright (5%) and Sanlu (8%) have been decreasing. The remaining 56% of market share is split between over 1000 other smaller dairy companies. (See chart below for further details). Mengniu and Yili were the first companies to introduce UHT milk into China, which was an important driver behind their substantial market share growth. However, we have already begun seeing a

Source: China Dairy Yearbook 2006

A major challenge for China’s dairy producers is the distribution and price sensitivity of raw milk (the sector’s primary input). Throughout 2007 raw milk prices grew substantially as food inflation rose. Raw milk prices were further exacerbated by droughts, the EU’s removal of milk powder export subsidies, and livestock being slaughtered due to higher feed costs. Making matters worse for Mengniu and Yili, neither own significant cattle ranches, forcing them to source raw milk from third parties, making these companies even more susceptible to increases in raw milk prices and supply disruptions. Mounting raw milk prices coupled with the government’s dairy price controls have placed significant pressure on the industry. Nevertheless, on a positive note food inflation has begun to moderate, and the government recently approved price increases for a number of dairies. All in all this should help alleviate some of the pressure the sector has experienced over the past year.

Foreign competition has been somewhat limited in the Chinese dairy sector, primarily existing only in the powdered milk segment. Given entry barriers to the sector and China’s, in many cases, inefficient raw milk suppliers we do not expect foreign competition to increase significantly in the short-term. Moreover, we expect to see considerable consolidation in the domestic Chinese dairy industry. Many of China’s smaller dairies are regionally focused in China’s rural areas. As China’s larger dairies continue accessing these areas, smaller producers will likely be unable to compete in terms of costs, and could be forced out of business our acquired by bigger names. Furthermore, given the increased competition amongst domestic players and the likely shift to higher value added products in urban areas dairies will need to increase spending on R&D and marketing to for product development and brand recognition. Only those companies with strong cash flow and significant market share will likely be able to cannibalize these necessary extra expenses.

Join the discussion