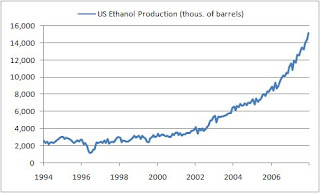

US Ethanol Production has been increasing drastically

So what does this mean for food?

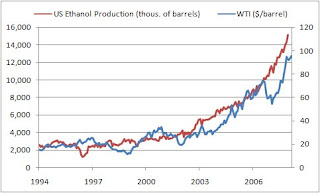

We are all aware that global food prices are rising sharply for a variety of reasons including weather and demand and supply shocks, but have energy prices had any affect?. Below we outline our view that the increasing in oil prices, have led to a substantial rise in ethanol production, and will have significant effect on food prices and eventually overall CPI. In order to have a consistent time series of agricultural prices we used the USDA prices received by farmers’ data. First off, let’s look at the relationship between WTI prices and ethanol production (chart below). As you can see below the two variables are highly correlated, this makes sense since the price of producing ethanol relative gas drops as oil prices move higher. However, the important question is what effect (if any) does the increased production of ethanol have on the food supply and prices?

High energy prices have been the driver behind the increased production

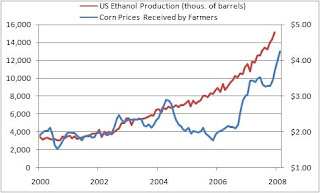

To answer this question we first analyzed corn price verse ethanol production (chart below). Again we see a strong correlation between the two, with the only anomaly being in 2005. This was caused by a good harvest and the effects of Hurricane Katrina. As we stated early the price of corn is influenced by a number of variables. Given the minimal use of ethanol prior to the beginning of this decade we do not believe ethanol production has had much, if any, affect on corn prices before now. In 1999 only 1.5bn gallons of ethanol were produced a year verse over 5bn today. That’s a lot more corn! Now that we now the production of ethanol can influence corn prices, what is the relationship of corn prices to the food and beverage CPI component and overall CPI?

Corn Prices have been influenced by ethanol production

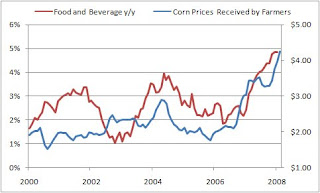

Before we start this analysis lets mention some important direct uses of corn; food, corn syrup, animal feed, ethanol, etc… Meaning corn prices can influence everything from candy to milk. Now with this in mind, we would expect a significant rise in corn prices to eventually pass-through the food chain into every product that utilizes corn. In the chart below we compared corn prices to the food and beverage component of the US CPI on a y/y basis. Again the result was not surprising; the food and beverage component of the CPI has been increasing with corn prices. Given the wide spectrum of uses for corn it is hard to judge the total effective corn would have in the index (at least for this brief analysis), but we imagine it is significant.

Corn prices have helped to drive up the overall food and beverage CPI component

Conclusion:

The massive increase in ethanol production brought on by elevated energy prices has had a significant effect on corn prices. This means that as long as energy prices remain elevated, and corn is used as the primary crop to produce ethanol, we can expect to see the prices continue on this path. Given corns multiple uses within the food industry, we can also expect to see the food and beverage component of the CPI increase as a result. Also as lower value crops are switched over to corn we may also see a rise in the price of other crops as supply comes down. One alternative on the horizon is using switchgrass instead of corn to produce ethanol. It is believed that switchgrass will be a more efficient producer of ethanol and also will not directly impact the food supple, since you can’t eat it. However, this is still in an experimental stage and will take time. The bottom line is, so long as energy prices continue to rise and ethanol production along with it, we can expect to continue seeing the food and beverage component of the CPI trending up.

Investment Idea:

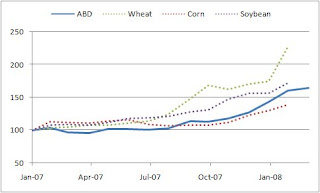

If you believe that the price and value of agricultural goods will continue to rise from cross-over to energy products and higher world demand, we recommend purchasing agriculture based ETFs such as ‘MOO’ or ‘DBA’ as a good play on the sector. However, it is important to keep in mind that speculators may have artificially driven up prices in agro indexes, so it is possible that we could see the indices catch a bid in the short-term.

Price of DBA vs wheat, corn, & soybean (rebased to 100)