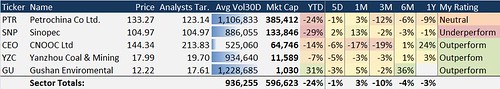

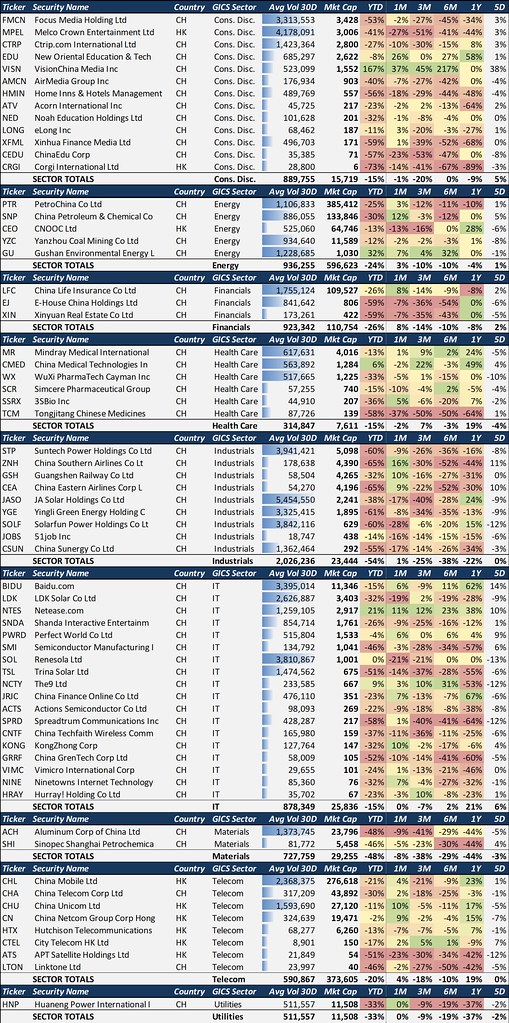

As an additional follow-up to my ADR series, I am going to take a look at the Chinese and Hong Kong healthcare sector. There are 6 key Chinese and Hong Kong ADRs within the GICS healthcare sector: Mindray Medical International (MR), Chine Medical Technologies (CMED), Wuxi PharmaTech (WX), Simcere Pharmaceutical (SCR), 3SBio (SSRX), and Tongjitang Chinese Medicines (TCM)

Chinese & HK Helathcare Sector ADRs

Source: Bloomberg (Closing prices 8/7)

The Companies:

Mindray Medical International (MR, Outperform): Mindray Medical International Limited develops, manufactures, and markets medical devices. The Company offers patient monitoring devices, diagnostic laboratory instruments, and ultrasound imaging systems. (Bloomberg)

MR’s outlook in a nutshell: Unlike the other companies discussed in this piece MR has significant exposure to both Chinese and ex-China markets; it is also the country’s largest medical device company. The medical devices sector is still in its infancy in China, and MR is well poised to benefit from an expanding market. MR specializes in patient monitors, diagnostic lab equipment, and anesthesia & ultrasound machines. Earlier in 2008 MR acquired a U.S. patient monitoring business from Datascope (DPM). MR is currently in the process of integrating DPM’s operations; it will likely take 1.5 to 2 years for the full synergies of this deal to be unlocked. Nonetheless, unlike MR, DPM’s sales were mostly targeted around hospitals in the U.S. and Europe, this should prevent most sales cannibalization, and give MR good exposure to new markets and technologies. This acquisition adds significant upside potential to MR’s future growth potential. Looking at the immediate impact, MR just received FDA approval for DPM’s next generation AS3000 anesthesia delivery system, which is a strong entry into a USD250mn a year market. On the home front, MR has been partially supported by public healthcare reforms, and an initiative to provide medical equipment to rural hospitals; this trend will likely not let up anytime soon. Additionally, MR’s robust pipeline should continue supporting the companies bottom line. MR’s pipeline includes digital radiography equipment, a digital defibrillator, and various other patient monitoring and chemical analysis equipment. The digital radiography system is a high-res X-Ray machine utilizes digital vs. traditional film, allowing for simpler analysis and digital storage. I see significant upside for MR given its strong domestic position, and growing international presence. This together with stronger medical device demand in China, a successful integration with DPM, and its innovative product line MR should continue to experience strong growth for the foreseeable future. (Expected Q208 Earnings Report 8/20/08)

Events which could improve outlook:

- Exceeding 2008’s company guidance of USD560-580mn in revenues and USD132-134mn for income.

- Successful integration of DPM, with stronger than anticipated synergies (i.e. cross-selling)

- Stronger domestic and international demand for MR’s product line.

Events which could deteriorate outlook:

- Higher costs and potential FX risk.

- Increased competition in both the domestic and foreign markets.

- Changes in government policy reducing domestic sales or prices.

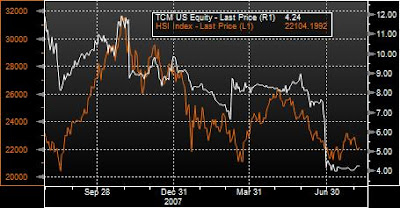

MR vs. Hang Seng

Source: Bloomberg

China Medical Technologies (CMED, Outperform): China Medical Technologies, Inc. is a medical device company that develops, manufactures, and markets products using high intensity focused ultrasound, or HIFU, for the treatment of solid cancers and benign tumors in China. (Bloomberg)

CMED’s outlook in a nutshell: CMED has a unique characteristic when it comes to Chinese healthcare companies; it is the only company in China certified to conduct FISH testing. FISH testing (fluorescence in situ hybridization) is a genetic test that can detect chromosome abnormalities, and can be used prenatally to detect Down’s syndrome among other genetic conditions. Given CMED’s currently monopoly and China’s untapped potential, this segment should help support CMED in both the short and long term. CMED’s other primary segments include ECLIA (electrochemiluminescence immunoassay) and HIFU (high intensity focused ultrasound). These segments should also continue to demonstrate growth, but at a slower pace than the company’s FISH business. It is expected CMED will be granted further approvals by the SFDA that will permit it to increase FISH advertising, and and widen the scope of the testing. Additionally, we seen significant improvements in the company’s margins, primarily due to an increased emphasis on high margin reagent products, and limiting the sale of low margin equipment, such as microscopes. This strategy has led to a non-GAAP margin increase to 79.1% from 72.3% for 1Q08 vs. 1Q07; I anticipate this growth rate will moderate, yet remain slightly above current levels. Recently, the company initiated a new business model where by it gives free ECLIA equipment to new customers, who in turn end up purchasing high-margin reagent products to operate the machine. In the short-term this may add some pressure onto CMED’s bottom-line, but will be more than offset via longer-term reagent sales. All in all, I believe CMED is a great play in the Chinese healthcare industry given its unique position regarding the FISH test, and new strategy emphasizing higher margin products. (1Q08 Earnings Report 8/04/08 Est: 0.52 Act: 0.42)

Events which could improve outlook:

- Further SFDA approvals for new FISH probes.

- Continued growth in company margins.

- Reaching or exceeding expectations of 500 hospitals with FISH capabilities by the end of 2008.

Events which could deteriorate outlook:

- Increased competition.

- Lower than anticipated FISH sales.

- Changes in government policy adversely affecting the sector.

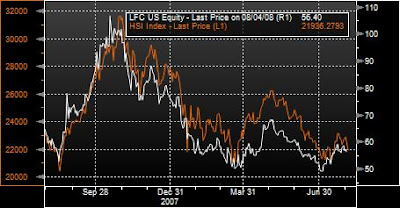

CMED vs. Hang Seng

Source: Bloomberg

Wuxi PharmaTech (WX, Neutral): WuXi PharmaTech Cayman Inc. provides pharmaceutical and biotechnology research and development outsourcing. The Company’s services include discovery chemistry, service biology, analytical, pharmaceutical development, and manufacturing. (Bloomberg)

WX’s outlook in a nutshell: While the CRO business should remain robust in China, WX’s recent acquisition of AppTech, a biologics manufacturing company raises some concerns. WX is a market leader in China’s CRO industry, and this portion of its should remain strong over the next several years. In fact, on June 24th 2008 WX announced a memorandum of understanding to create a 50-50 joint venture for contract research with Covance. The joint venture will be located at WX’s Suzhou facility; specific financial terms are expected to be released once the deal is complete. This deal should help bolster WX’s CRO business over the next several years. However, WX’s USD169mn acquisition of U.S. based Apptech add a cloud of uncertainty over the company’s overall outlook. It is likely this deal will create significant cost pressures, and lead to higher earnings variance due to the volatility of biologics manufacturing. All in all, given the recent Apptech acquisition and the potential for increased costs and compressed margins we do not see much upside potential for WX. (Expected Q208 Earnings Report 8/13/08 Post-market)

Events which could improve outlook:

- Strong demand for biologics manufacturing.

- Significantly higher CRO business in China.

- Streamlined integration of Apptech combined with successful cross-selling initiative.

Events which could deteriorate outlook:

- Increased costs from Apptech acquisition.

- Decrease in biologics demand.

- Slow-down in CRO business

WX vs. Hang Seng

Source: Bloomberg

Simcere Pharmaceutical (SCR, Neutral): Simcere Pharmaceutical Group manufactures and supplies branded generic pharmaceuticals to the China market. The Company’s products include antibiotics, anti-cancer medications and anti-stroke medications. (Bloomberg)

SCR’s outlook in a nutshell: SCR and the Chinese generic drug sector in general face strong competition. SCR’s sales suffered in Q208, primarily due to shifting to a lower margin sales model in the face of potential competition. I expect SCR will continue to face growing competition in many of its existing lines, further compressing margins. Nonetheless, SCR has at least one first-to-market generic expecting approval during 2H08, which could help bolster sales and sustain margins. Given China’s untapped potential in the healthcare industry, SCR should continue experiencing sales growth in its generic markets. SCR will likely continue to target the large potential in small & medium sized hospitals and pharmacies, which should help sales volumes. Nonetheless, increased volumes may not be enough to off-set the impact of lower prices in an environment of increased competition. Looking at 1Q08 we can already see some of the potential impact on margins. Furthermore, a SCR competitor that manufactures a Yidasheng rival, is selling its drug slightly below Yidasheng’s current price, which could lead to further pricing pressure. SCR noted on its 2Q08 earnings call that it is considering acquisitions given its strong cash base. All in all, despite the fact that we believe SCR’s sales volume will continue to expand, it will likely be at least partially off-set by lower prices due to increased competition. (2Q08 Earnings Report 8/05/08 Est: 1.44 Act: 1.48)

Events which could improve outlook:

- Stronger than anticipated drug sales.

- Competitors bringing rival drugs onto market slower than expected

- Approval and eventual ability to market drugs in SCR’s pipeline including Biapenem, Palonosetron, Iguratimod, and Levamisole.

- Any significant acquisition that could improve SCR’s bottom line.

Events which could deteriorate outlook:

- Continued pricing pressure from competitors.

- Lower than anticipated drug sales.

- Rejection of drugs in SCR’s pipeline.

- Any government regulation regulating drug costs.

SCR vs. Hang Seng

Source: Bloomberg

3SBio (SSRX, Outperform): 3SBio, Inc. is a biotechnology company. The Company researches treatments in the areas of nephrology, oncology, supportive cancer care, inflammation, and infectious diseases. (Bloomberg)

SSRX’s outlook in a nutshell: SSRX is a growing company in a Chinese growth sector. SSRX’s two main products are EPIAO and TPIAO, experienced record sales increases in 1Q08 of 42% and 104%, respectively. EPIAO is an EPO drug, which helps stimulate the body’s red blood cell production that can be prescribed to patients with anemia, or who are undergoing chemo-therapy. According to the company, in Europe roughly 17% of chemo-patients are prescribed EPO, while in China the ratio stands at 2%, implying significant growth potential. TPIAO is a THPO treatment, which increases the body’s production of platelets; this drug can also be prescribed to oncology patients. Looking ahead SSRX has a potentially strong pipeline, with its high dosage EPIAO treatment and second generation IL-2 treatment, both finishing Phase III trials. SSRX expects to file with the SFDA regarding both these drugs during 2H08. By the end of 2008, SSRX also intends on filing with the SFDA in order to be granted permission to use TPIAO as a treatment for ITP, a bleeding disorder. Management expects to continue investing heavily into the company’s core business, increasing sales force and expanding capacity. Despite the potential for rising costs due to managements expansion plans, I foresee SSRX further penetrating China’s oncology market while maintaining strong and stable margins. All in all given SSRX’s growth and future pipeline, I believe SSRX is a good play in the Chinese healthcare industry. SSRX is a growth company with a management team who appear to be making wise investment decisions towards long term sustainable growth. Interesting to note is that SSRX has the right to buy-back company shares through March of 2009. Lastly, I expect the company could upwardly revise its 2008 guidance during its Q208 earnings call, this of course depending on 2Q results. (Expected Q208 Earnings Report 8/12/08 Post-market)

Events which could improve outlook:

- Improved 2008 company guidance.

- Stronger than anticipated EPIAO & TPIAO sales.

- Approval of new treatments by the SFDA.

Events which could deteriorate outlook:

- Strong competition from other market players, which could reduce market share or add pricing pressures.

- Any pipe-line drugs failing to get approval from the SFDA.

- Higher than anticipated costs reducing margins.

SSRX vs. Hang Seng

Source: Bloomberg

Tongjitang Chinese Medicine (TCM, Neutral): Tongjitang Chinese Medicines Co. is a pharmaceutical company. The Company develops, manufactures and markets modernized traditional Chinese medicines. (Bloomberg)

TCM’s outlook in a nutshell: I am hesitant on TCM’s outlook for several reasons 1) nearly 80% of TCM’s revenue comes from its Xianling Gubao product alone, which is used to treat osteoporosis; 2) the traditional Chinese medicine industry is extremely competitive; & 3) canceling its privatization due to what was reported as a deteriorations in the credit market. All in all, if it were not for this equities recent sell-off after the cancellation announcement I would have rated them ‘underperform’, but given the sell-off and challenges the company still faces I don’t see much upside or downside for TCM.

Events which could improve outlook:

- Higher than expected earnings.

- Re-initiating privatization.

- Creating a more robust product base.

Events which could deteriorate outlook:

- Slower than anticipated sales of Xianling Gubao.

- Earnings below expectations.