US Week Ahead: It’s all about the jobs!

Monday June 29th:

8:30AM: Chicago Fed National Activity Index (Risk: Neutral, Market Reaction: Marginal): The CFNAI is an index of 85 separate data sets designed to represent national economic activity and inflationary pressure. A reading of 0 indicates the economy is growing at the historical trend while a negative or positive result indicates the economy is growing below or above its historical average, respectively. Given the volatile nature of this index the three month moving average is typically quoted. This index remains somewhat obscure in the mainstream media and is likely to have a minimal impact on trading.

Tuesday June 30th:

7:45AM: ICSC-Goldman Store Sales (Risk: Downside, Market Reaction: Moderate): This weekly index tracks same store sales at major US retailers, and accounts for roughly 10% of national retail sales. Given recent data supporting an increase to the US saving rates, this index could face some downward pressure as people save more and spend less.

9:00AM: S&P Case-Shiller HPI (Risk: Neutral, Market Reaction: Marginal/Moderate): Despite, the significance of US home price data, this index holds a two month lag, meaning this June’s data would actually be from April. This lag marginally reduces the index’s importance compared to some of the other more timely housing market indicators. Nevertheless, large movements in this index could imply further deterioration or recovery of the US housing market, which could impact trading.9:45AM: Chicago PMI-

Business Barometer Index (Risk: Downside, Market Reaction: Marginal/Moderate): The Chicago PMI measures business conditions in the Chicago area; anything below 50 indicates a contraction while a reading above that level implies an expansion. According to Bloomberg, the market is currently forecasting a reading of 44.5. However, given recent weakness in the auto and manufacturing sectors I expect this number could disappoint. It will be important to pay close attention to the new order and prices paid sub-components. The new oders component tends to be forward looking, while the prices paid component experienced a 60 year low of 28.4 in April.10:00AM: Consumer Confidence (Risk: Upside, Market Reaction: Moderate): The confidence index, which measures consumers’ attitudes towards present and future economic expectations can be a good barometer for consumer spending. This index has recently experienced significant gains as consumers’ seem to be focusing on positive economic releases. The current conditions index has remained somewhat stagnant, while the future expectations index experienced an increase of over 20 points last month. However, some deterioration in recent employment data could put some downward pressure on this month’s release, but I still believe this index is more likely to surprise to the upside.

Wednesday July 1st:

7:00AM: MBA Purchase Applications (Risk: Neutral, Market Reaction: Marginal): This index, which tracks new mortgage applications tends to be a reasonable forward looking indicator for home sales, but issues including customers filling out numerous applications could skew the index.8:15AM: ADP Employment Report (Risk: Neutral, Market Reaction: Moderate): The ADP employment report is typically considered a good indicator of the payroll data released later in the week, so a big swing in this data could shift expectations for the employment data released on Thursday and thus significantly impact trading.

10:00AM: ISM Manufacturing Index (Risk: Neutral, Market Reaction: Significant): The ISM measures national manufacturing conditions, a reading of over 50 signifies expansion while under a retraction. The current consensus on Bloomberg is 45. It will be very important to look at the new orders component of the ISM, which tends to be a forward looking indicator for the overall index. New orders finished over 50 last month, for the first time in 17 months, but will likely move back below 50 this month.10:00AM: Construction Spending (Risk: Upside, Market Reaction: Marginal): This index tracks the value of new construction activity on residential, non-residential, and public projects. Recent stimulus spending should help drive up the public projects component of the index, and we will likely see a marginal increase in residential spending.

10:00AM: Pending Home Sales

(Risk: Neutral, Market Reaction: Moderate): A strong number in this index would help support the case of a recovery in the US housing market, which could have a moderate impact on trading. However, it is important to note that not all pending home sales turn into actual sales, but it is a good indicator of sentiment. June Motor Vehicle Sales (Risk: Downside, Market Reaction: Moderate): Increasing savings rate, tight credit conditions, and a weak job market will likely cause car owners to extend the life of their current vehicles, despite incentive offers, reducing total car sales. This will also be exacerbated by what has recently been increasing gas prices. 7.4mn cars and light trucks were sold in May.Thursday July 2nd:

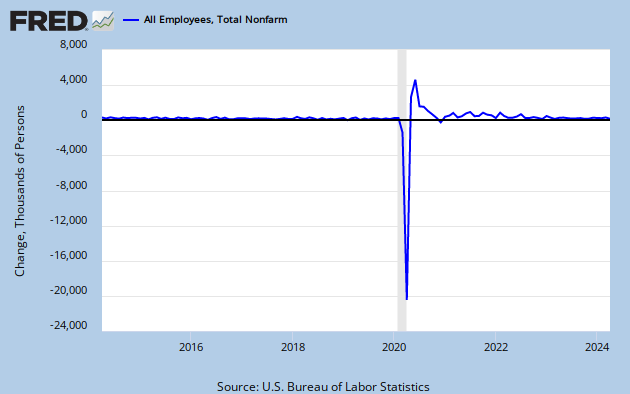

8:30AM: Employment Situation Report (Risk: Neutral, Market Reaction: VERY Significant): According to Bloomberg, the current market consensus for the change in payrolls stands at -350,000 with an unemployment rate of 9.6%. The average decline in payrolls for the six months preceding April was 643,000 versus 345,000 in May. The market will likely interpret another positive surprise as the beginning of a recovery in the US employment situation, which would lead to a strong rally in equities and selloff for US treasuries; a negative surprise would have the opposite effect. Nevertheless, the unemployment rate will likely drift above 10% in the comings months.8:30AM: Initial Claims (Risk: Downside, Market Reaction: Significant): This report will be overshadowed by the payroll data, released simultaneously, but is an excellent forward looking indicator for the employment sector. We could see an unexpected jump in claims as the school year ends and teachers who have lost their jobs due to budget cuts begin filing for claims.

10:00AM: Factory Orders (Risk: Upside, Market Reaction: Moderate): Given the recent increment in durable goods orders we could see factory orders surprise to the upside. According to Bloomberg the current consensus forecast for May is a month over month increase of 1.4%. Friday July 3rd:

Enjoy the long weekend!

Join the discussion